Bitcoin futures contracts could be on shaky ground, if the new lows in open interest are any indication. Could investors be working to protect themselves with newly closed positions? Would more stability increase or decrease prices of these contracts?

- Low open interest could be due to a few different reasons, like the closing of books by traders.

- Bitcoin futures contracts are based on the future predicted price of the volatile crypto asset.

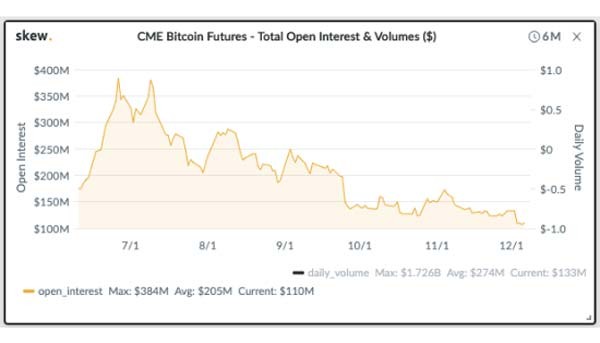

The Chicago Mercantile Exchange (CME) established itself as the second exchange to ever offer open interest on Bitcoin futures. However, based on reports from Skew analytics, this option has just recorded the lowest numbers for the last six months.

Open interest in futures is drastically different from the average exchange’s open volume or trading volume. Futures allow traders to buy an asset with a future price of a contract, and the open interest shows the willingness of investors to risk on the future value estimates, as BeInCrypto explains.

Right now, CME leads the industry in their diverse derivatives market, allowing traders to engage in a variety of investment instruments. The exchange shows the highest trading volumes for Bitcoin futures, though the decline in open interest could be attributed to a few causes. Traders may be closing out their books ahead of portfolio finalization, for example.

Futures are predictive, and Bitcoin is known for having been relatively volatile, leaving the market to essentially be unpredictable. The lack of open interest could be an indication that the traders are uncomfortable with the lack of predictability of the future of the market. Furthermore, traders could be concerned of the reaction of the market through the upcoming halving that Bitcoin will go through. If miners decide to sell off their own holdings could force the price to drop in short increments, leaving traders in a bad position.

Even though, as a trading vehicle, futures are rather an interesting product, they don’t actually show where the prices are heading. Still, the fact that open interest has declined shows that many investors are trying to protect themselves by closing up positions. As these contracts close, liquidity in the futures market decreases, since every contract must have both a buyer and a maker.

The halving is coming. Still, low open interest could push prices up if traders work to open new positions, if the market becomes a little more stable.