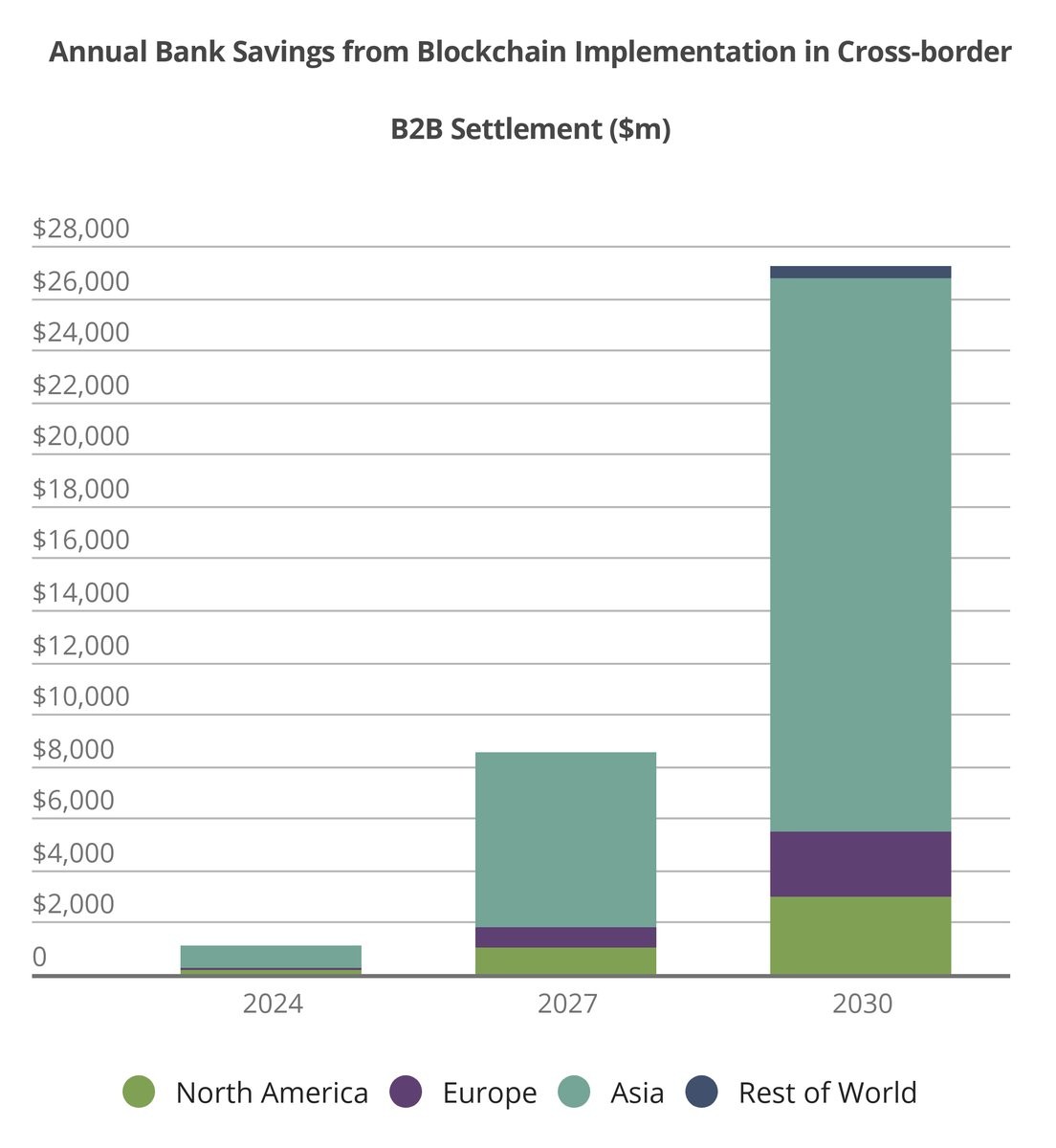

A new study from Juniper Research, the UK-based analyst firm in the mobile and digital technology sector, has found that blockchain deployments will enable banks to realize savings on cross-border settlement transactions of more than $27 billion by the end of 2030, reducing costs by more than 11% per on-chain transaction.

According to the research, 'The Future of Blockchain: Key Vertical Opportunities & Deployment Strategies 2018-2030', banks that integrate blockchain will achieve cost reductions not just in payment processing and reconciliation, but in treasury operations and compliance. The research argued that in compliance, automation of identity/money-laundering checks, allied to the capability of the blockchain to verify the digital identity of an individual, should enable savings of up to 50% of the existing costs base within a few years.

However, the study cautioned that the need to parallel-run blockchain-based services with legacy systems would mean that savings would not be realized for several years after initial deployment, with annual cost reductions not reaching $1 billion per annum until 2024.

The research also highlighted food sector as a potential beneficiary of blockchain - from reduced fees for home buyers to fraud in the food export trade, where it estimated that blockchain deployments would reduce the cost of fraud by nearly 50% within 12 years.

Interestingly, according to the research, IBM stood out as a leader in blockchain innovation. The research includes 3 Innovation Indices (Digital Identity, Provenance, and Financial Services) based on the quantitative and qualitative assessment of product offerings, R&D activities, and future potential. In each index, IBM emerged as a market leader. According to research author Dr. Windsor Holden:

“IBM continues to demonstrate innovation and leadership across a range of verticals. Over the past 18 months, it has attracted dozens of corporate clients, with deployments now moving from proofs of concept and trial to full commercial rollout.”