There are several reasons why you may want to sell off all or part of your Bitcoin. Perhaps you feel the Bitcoin bubble will soon go bust, or you feel you’ve amassed enough digital wealth and want to get out of the Bitcoin market. It could also be that you need to raise some much-needed cash. Whatever your reasons for selling off, this article will explore the different ways you can do this.

Selling of your coins is as simple as buying them. Almost all methods available to buy Bitcoin allow you to sell them, with the exception of Bitcoin ATMs.

Some actually allow you to exchange your coins for cash, but not all of them. You can also decide to exchange a few of your Bitcoins for other forms of cryptocurrency.

However, if your original plan is to sell, then read on to find out how.

Selling via exchange platforms:

This is possibly the simplest and most automated way to convert your Bitcoin into cash. An exchange platform serves as a “middle man” to connect you to potential Bitcoin buyers. Two of the most famous examples of Bitcoin exchange platforms are Coinbase and Kraken. If you cannot get a good deal on these two platforms, then you can look for more on Icotokennews.com.

Whichever platform you choose to sell on, the process is virtually the same.

- First, you need to create a wallet with the exchange you want to work with, then you can either link your bank account to it, or your local currency wallet, if available.

- Next, you transfer your Bitcoins to your new account on the exchange platform, just like you would with any other Bitcoin transfer or transaction. You can locate your exchange wallet address or code when you log in. This is where you send the coins you want to sell to.

- After depositing the coins, you need to place a “sell order”. Normally, your Bitcoins will be placed on the market at the current going rate. However, some exchanges will allow you set a limit on how low they should sell so that in the event that prices drop below that point, the sale will not go through.

- Once your coins have been sold, its equivalent in local currencies will be transferred into your bank account or wallet. If it is sent to your local currency wallet, you can manually move it to your bank account whenever you choose.

- When you use exchange services to sell your Bitcoins, note that you have to pay a small percentage of the transaction as exchange fees. This is simply for using their services and nothing else.

Some exchange platforms will require that you show some proof of identification, such as an ID card or a driver’s license. This identification will have to be manually verified by the exchange service before you can sell your coins.

It is important that you do an in-depth research of the exchange service you want to use before signing up and transferring your funds. There’s the risk that some unscrupulous exchange sites will run away with your hard earned coins, or they may not be secure enough and can be a victim of a security breach. If you make the mistake of choosing the wrong exchange, you stand the risk of losing your money.

Selling via direct trade:

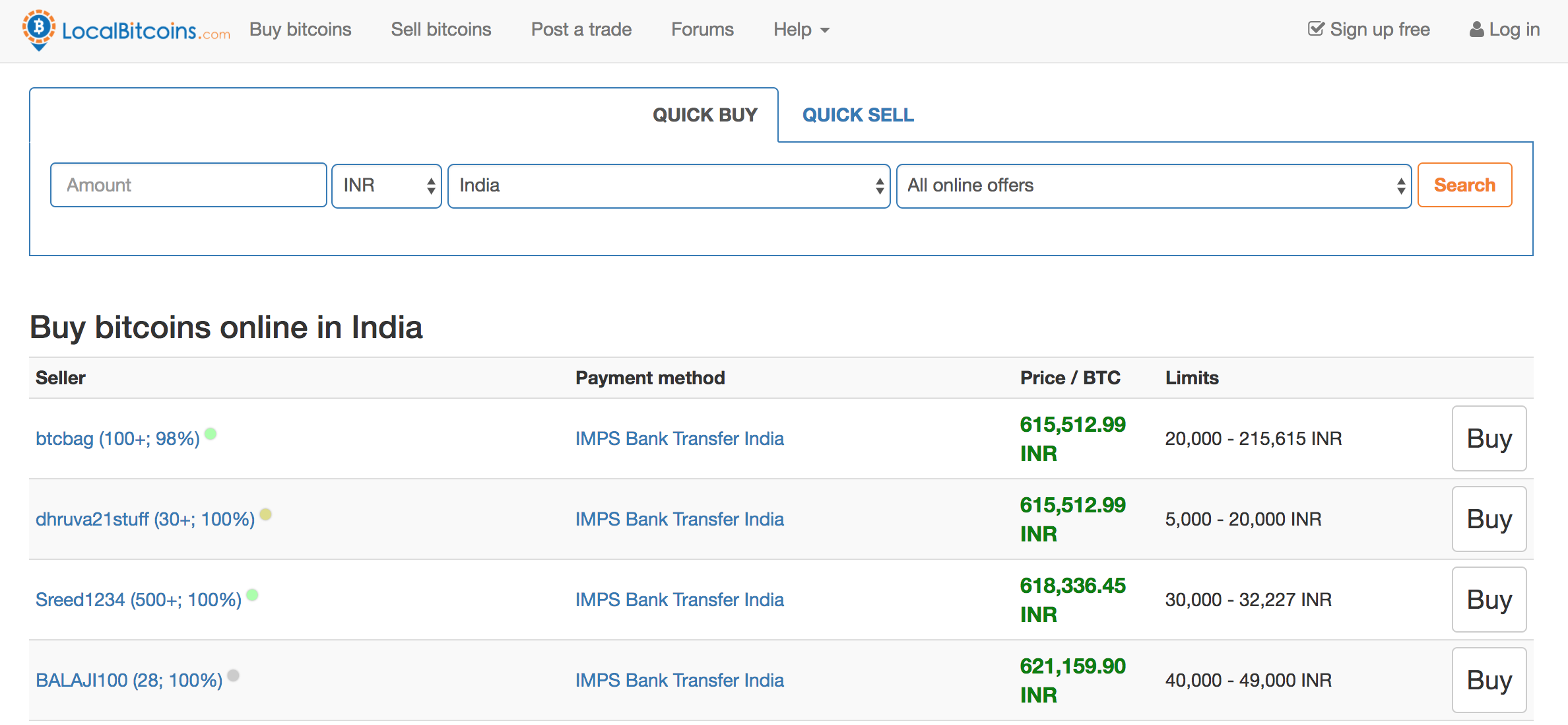

Selling your Bitcoins via direct trade allows you to have a hand in the sales process. The direct trade also known as peer-to-peer trade offers a more hands-on alternative for selling your Bitcoins. Just like with exchange platforms, you will need to sign up and maybe confirm your identity before you can proceed. However, rather than have the sites place your coins on the market, you directly deal with interested buyers.

The actual method involved with selling your Bitcoins can vary by sites, but the process is mostly similar.

- You will need to first sign up on a peer-to-peer website such as Local Bitcoins of Paxful and confirm your identity.

- Next, you specify the number of coins you want to sell and your price.

- The system will notify you when a buyer indicates interest in your Bitcoins at the price you indicated.

- Once you’re ready to proceed, the website will notify the buyer in turn, who’ll pay you for the number of coins he or she needs.

- After you’ve confirmed the payment, you can send the requested coins to the new owner.

Different websites offer different methods of payment. You can receive your payment in USD, or a local currency if you are using a local peer to peer site, or dealing with a local buyer. You can also receive your payments as gift cards, money order or even person to person cash.

When selling your coins via direct trade, it is important that you and the buyer arrive at a reasonable mode of exchange. Make sure you don’t send the coins before receiving your funds so you don’t fall prey to scammers and thieves.

Person to person sale:

This method involves putting your Bitcoin on the market yourself without using any third party platform. Most people advertise on their social media profiles and message boards.

There is a very little process involved in this method. You simply choose where you want to advertise your coins. It could be on Facebook, Twitter or Reddit. It could also be done via word of mouth, or email and texts to friends.

Once you have a potential buyer, you simply meet in a public and safe place to carry out the transaction. Person to person sales is ideal for people in the sale locality or region. However, it is important that you make the trade in a public place where safety is guaranteed. Even if you are selling to a friend you met on social media, you need to take a few precautions.

Conclusion

As earlier pointed out, you can choose to sell your Bitcoins for any of the more common cryptos. This is a good idea if you are not selling to raise cash, but to spread your investment risk. Not only will you minimize your losses in the event of a Bitcoin bubble burst, but you can also make tremendous gains should the other crypto coins appreciate in value.